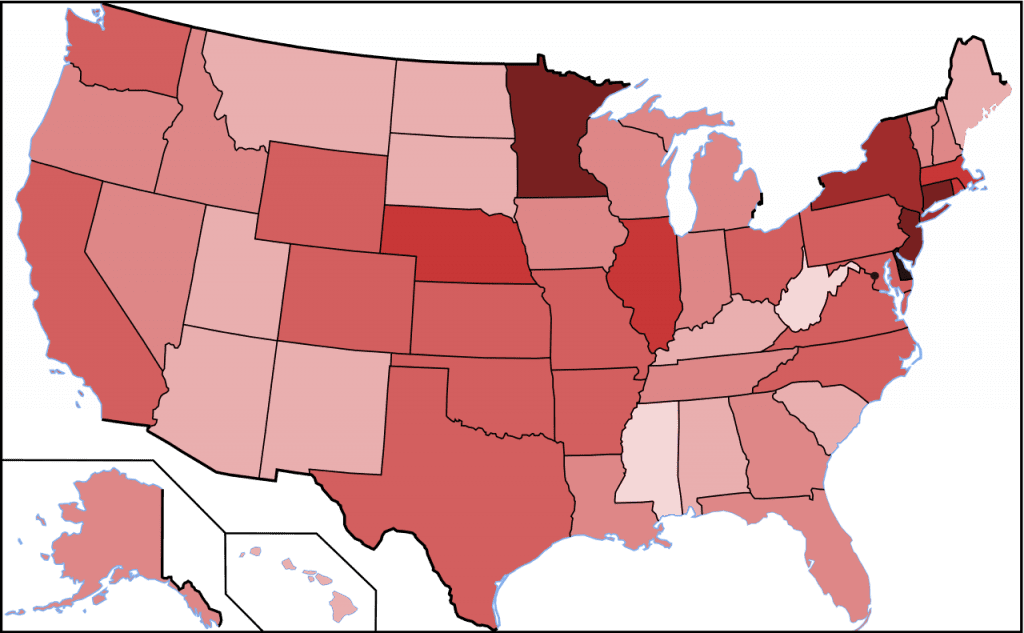

The best states to retire, ranked by cost of living

Finance 101

October 15, 2019

Carla DeMaio

TastyCakes/Wikimedia Commons (creativecommons.org/licenses/by/3.0/deed.en)

When we reach retirement age, a lot of us plan to move to that dream state we always pictured ourselves growing old in. Some of us move for lower costs of living, better healthcare, and friendlier tax laws, and others move for better weather and family.

We ranked 50 states from the highest cost of living to the lowest, with data on tax breaks, annual income, and healthcare costs. These were taken from Kiplinger, Milken Institute, National Association of Realtors, Bureau of Labor Statistics and more.

Remember, it’s important to consult various sources when considering retirement. Take our list with a grain of salt as it’s written for entertainment purposes only.

50. Hawaii

Cost of living: 87 percent above U.S. average

Population: 1.4 million

Best city: MaunawiliPRO:

The best city for retirees in this tropical state is Maunawili on the island of Oʻahu, says Niche.com. It’s home to popular hiking destinations and close to the state capital, Honolulu. Hawaii, in general, is full of nature and water sports.CON:

The cost of living is pretty high in Hawaii — 87 percent above average. That’s even higher than the other sunshine state, California. The average income for 65 plus individuals is over $71K, says Kiplinger. Few in its population meet U.S. poverty guidelines.

dennisflarsen/GoodFreePhotosNEXT: Yikes! This is one of the states that rests on two major tectonic plates.

49. California

Cost of living: 52 percent above the U.S. average

Population: 39.56 million (as of 2018, U.S. Census Bureau)

Best city: Beverly Hills, says Yahoo! Finance (if you can afford it!)PRO:

It’s hard to argue against California’s natural beauty. The state has forests, beaches, deserts, and more. It’s home to big cities for those craving fast-paced living.CON:

This state has the second highest costs of living after Hawaii. If you want sunny weather, you’ll have to pay up! Some are and it’s costing them — 19 percent of California’s population lives in poverty, says the U.S. Census Bureau.

Pedro Szekely/FlickrNEXT: Basketball was invented in 1891 by James Naismith in this state.

48. Massachusetts

Cost of living: 38 percent above the U.S. average

Population: 6.902 million (as of 2018, U.S. Census Bureau)

Best city: Northampton, says ForbesPRO:

This is a state with a lot of history — the Boston Tea Party, one of the 13 original colonies, the landing place of the Mayflower, and more.CON:

Massachusetts, also known as the Bay State, has lots of costs for retirees, says Kiplinger. There are high living costs at 38 percent above the U.S. average, high healthcare costs and it isn’t tax-friendly. If you hate the cold, East Coast winters aren’t for you.

Martin Springall/FlickrNEXT: Its state flag was designed by a 13-year-old boy named Benny Benson.

47. Alaska

Cost of living: 32 percent above U.S. average

Population: 737,438 (as of 2018, U.S. Census Bureau)

Best city: Anchorage, says Yahoo! FinancePRO:

Kiplinger says the Last Frontier is extremely tax-friendly to retirees, but apparently not many take advantage of this. Alaska has a small population of seniors.CON:

Its costs of living are pretty high there — 32 percent above the U.S. national average, says Kiplinger. Health care costs are important for seniors and those are above the national average as well in Alaska. Also if you’re looking for big city living, Alaska isn’t your state!

Paxson Woelber/FlickrNEXT: “Gym, tan, laundry” was a famous catchphrase coined by Mike “The Situation” on the MTV reality show that took place in this state.

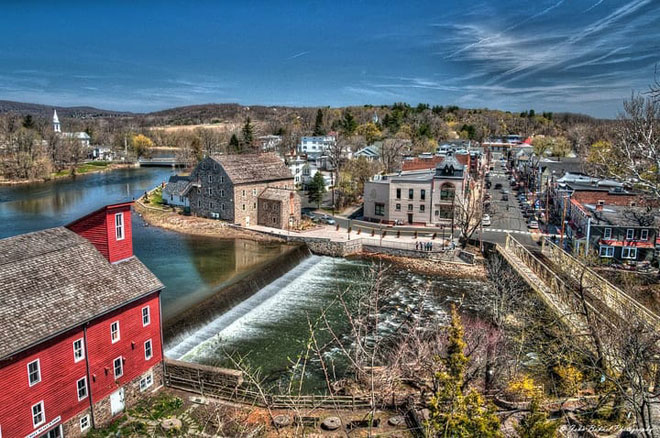

46. New Jersey

Cost of living: 27 percent above U.S. average

Population: 8.909 million (as of 2018, says U.S. Census Bureau)

Best city: Long Beach Township, Ocean County says NJ.comPRO:

It’s a state with plenty to do and see during your Golden Years. Walk the boardwalk and check out the ocean views in Ocean City or take a quick train ride into New York City. The Garden State has lots of history as well for those history buffs or the history-curious!CON:

Compared with places like Montana and South Dakota, New Jersey has a much higher cost of living. Medical care is pricey and so are property taxes, says Kiplinger. This isn’t a great option for low-income retirees or those looking to save money.

John Bohnel/Wikimedia CommonsNEXT: It’s home to the official submarine museum of the U.S. Navy.

45. Connecticut

Cost of living: 24 percent above the U.S. average

Population: 3.573 million (as of 2018, U.S. Census Bureau)

Best city: Darien, says AreaVibes.comPRO:

Income for seniors is some of the highest in the U.S., Kiplinger says. Even with the high cost of living, retirees may be able to afford it if they pick up a retirement job.CON:

It’s not very tax-friendly to retirees with real estate taxes some of the worst in the nation, says Kiplinger. Most retirement income is fully taxed and apparently, some residents may face taxes on their Social Security benefits. There aren’t many benefits to alleviate the burden either.

jglazer75/Wikimedia CommonsNEXT: Its state tree, bird and animal are the sugar maple, Easter bluebird and beaver, respectively.

44. New York

Cost of living: 22 percent above U.S. average

Population: 19.54 million (as of 2018, says U.S. Census Bureau)

Best city: Great Neck, says Yahoo! FinancePRO:

Living in New York City might be good for retirees — it’s very walkable with many necessities nearby and delivery services abound! Small apartments mean living quarters are very manageable.CON:

Although it’s fun and walkable, New York City (and New York state for that matter) are best for well-to-do retirees. It’s not very tax-friendly to retirees and 65 plus individuals suffer high poverty rates, says Kiplinger.

Sam Valadi/Wikimedia CommonsNEXT: It is the smallest state in size in the entire U.S. It covers just 1,215 square miles.

43. Rhode Island

Cost of living: 22 percent above U.S. average

Population: 1.057 million (as of 2018, says U.S. Census Bureau)

Best city: Jamestown, says Niche.comPRO:

One of the original 13 colonies of the U.S., Rhode Island has plenty of history for history buffs and ocean views for nature lovers. It’s located near huge touristy, metropolitan areas for those that love to sightsee.CON:

This small eastern state isn’t very tax-friendly, says Kiplinger. On top of that, the high cost of living (22 percent above U.S. average) might make a dent in the retiree’s wallet. If you’ve been saving for a long time, have a financially supportive family or maybe have won the lottery, Rhode Island can work out for you.

Falkenpost/GoodFreePhotosNEXT: This state was named after a U.S. president.

42. Washington

Cost of living: 21 percent above U.S. average

Population: 7.1 million

Best city: VancouverPRO:

Washington, in general, isn’t the cheapest place to live, but those craving the Pacific Northwest lifestyle at budget prices might head to Vancouver. There, retirees will find more affordability and the lack of a state income tax.CON:

Its cost of living is 21 percent above the national average, that’s less than California and Hawaii, but still might be an obstacle for some seniors. The average income for households 65 plus is over $55K, which might help balance your budget out.

Tiffany von Arnim/FlickrNEXT: Back in Revolutionary War days, this was the first state to declare independence from England.

41. New Hampshire

Cost of living: 18 percent above the U.S. average

Population: 1.3 million

Best city: GilfordPRO:

It’s quite tax-friendly in New Hampshire, says Kiplinger, as it doesn’t tax any retirement income. For those with lots of healthcare needs, the state ranks fifth for senior health, according to the United Health Foundation. An added benefit: its picturesque New England landscapes.CON:

You gotta pay up for those breathtaking landscapes, though! New Hampshire’s cost of living is pretty high compared to the national average, but it might work itself out considering the tax situation. There’s also the cold winters and humid summers to consider.

Max PixelNEXT: The state has more “ghost towns” than any other state.

40. Oregon

Cost of living: 18 percent above U.S. average

Population: 4 million

Best city: Gold BeachPRO:

Healthcare costs for a retired couple are usually 2.6 percent lower than the nation’s average. For the outdoorsy senior, there’s lots of nature to enjoy. Just make sure you don’t mind the rain! You’ll get plenty during the eight-month rainy season.CON:

Oregon isn’t tax-friendly. Social Security is exempt, but most retirement income isn’t and Oregon has one of the highest state income taxes in the U.S. at 9.9 percent. Also, income for seniors is pretty low, with an average of just over $45K.

Yurivict/Wikimedia CommonsNEXT: Edgar Allan Poe, poet of mystery and macabre, is from here.

39. Maryland

Cost of living: 17 percent above U.S. average

Population: 6.0 million

Best city: Chevy Chase VillagePRO:

Its average household income for folks 65 plus is the second highest in the U.S., on average about $70,874. Nice! Maryland is home to big city Baltimore and very close to the sights of Washington D.C.CON:

True, individuals do make more money here than the rest of the U.S., but this income gets taxed heavily in Maryland. Social Security isn’t taxed, but distributions from individual retirement accounts are. There’s also an estate and inheritance tax.

Art Anderson/Wikimedia CommonsNEXT: This state is home to the U.S.’s flagship Olympic Training Center.

38. Colorado

Cost of living: 17 percent above U.S. average

Population: 5.4 million

Best city: Colorado SpringsPRO:

Colorado ranks fourth in the United Health Foundation’s senior health rankings. It also has low rates of obesity and physical inactivity in its senior populations. Perhaps, those in the Centennial State will also live to be 100?CON:

If you want to buy a house in Colorado, be wary because the market is very competitive in places like Denver. The state’s high altitude will take some adjusting to, but then you’ll probably enjoy the pleasant weather.

PixabayNEXT: It became its own country in 1777 and finally joined the U.S. in 1791 as the 14th state. The popular U.S. Senator, Bernie Sanders, is in office in this state.

37. Vermont

Cost of living: 12 percent above the U.S. average

Population: 626,299 (as of 2018, says U.S. Census Bureau)

Best city: Hartford, says Niche.comPRO:

The Green Mountain State ranks highly for its senior healthcare, says United Health Foundation’s rankings. Nature lovers will appreciate its lush environment with many trees, lakes, rivers, wildlife, and scenic views.CON:

The state in which Bernie Sanders resides as Senator is considered one of the “Least Tax-Friendly” says Kiplinger. There’s also quite a pricey cost of living, making it a bit harder for low-income seniors to survive.

tpsdave2/PixabayNEXT: The “first Thanksgiving” was apparently held here, predating the Plymouth feast by two years.

36. Delaware

Cost of living: 11 percent above U.S. average Population: 967,171 (as of 2018, U.S. Census Bureau) Best city: Rehoboth Beach, says Niche.com (A+ score!)

PRO:

It was rated tax-friendly by Kiplinger — Delaware doesn’t tax Social Security benefits! It also exempts certain amounts of investment and pension income for people 60 plus. Seems like a pretty sweet deal for senior citizens!CON:

The cost of living is pretty high — 11 percent above the U.S. average, says Kiplinger. Seniors have below U.S. average incomes, possibly making it difficult to afford necessary things in Delaware for some seniors. If you have a thicc savings account, however, Delaware might be possible.

Dough4872/Good Free PhotosNEXT: The “first Thanksgiving” was apparently held here, predating the Plymouth feast by two years.

35. Virginia Cost of living: 7 percent above U.S. average Population: 8.3 million Best city: Roanoke PRO: Cost of living is more than the national average but it should balance out as incomes are high in Virginia. Healthcare, a big concern for most retirees, is generally inexpensive. In addition, Social Security isn’t taxed and residents 65 plus can deduct $12K of their income. CON: Seniors in poverty might struggle with the above average living costs. There are a lot of cool cities to check out in Virginia like Richmond, Roanoke, and Lexington, but they’re not big cities like Los Angeles or New York City. Head elsewhere for big city living. NEXT: Jell-O became this state’s official food. Kevin Boniface/Wikimedia Commons 34. Utah Cost of living: 4 percent above U.S. average Population: 2.9 million Best city: Salt Lake City PRO: Utah’s healthcare ranks second for seniors in the U.S. according to the United Health Foundation. There are also plenty of outdoor activities to take advantage of with five national parks, five national forests, and 43 state parks. CON: Utah isn’t that tax-friendly to retirees. It taxes Social Security, which might hurt seniors already in poverty. The Beehive State has the third-lowest poverty rate in the country for seniors. Its income levels are at the U.S.’s average, which won’t help struggling retirees. NEXT: This state’s name in Spanish means “snow-capped.” Skyguy414/Wikimedia Commons 33. Nevada Cost of living: 4 percent above U.S. average Population: 2.8 million Best city: Winchester PRO: This state has some sweet deals on taxes, for instance, no state income tax! Poverty rates for seniors are also pretty low (8.4 percent compared with the U.S. average of 9.4 percent). It’s also home to Vegas, baby! CON: The cost of living is a little bit over the nation’s average and temperatures can be extreme, ranging from 50 to 120 degrees Fahrenheit. Nevada’s year-round semi-arid desert climate might make it the driest state in the U.S. That might be good for folks with allergies, however. NEXT: Rice cakes were created in this state. Thomas Wolf/Wikimedia Commons 32. Minnesota Cost of living: 4 percent above U.S. average Population: 5.5 million Best city: Osseo PRO: This state is a good place for health-focused retirees. The United Health Foundation ranked it as the “healthiest in the country for seniors.” It’s also home to the renowned Mayo Clinic in Rochester, Minnesota. If you have complex health issues, this might be a good choice for you. CON: It’s got the not so great combination of higher than average cost of living and below average annual income. Minnesota also taxes Social Security as much as the Feds do. Other retirement incomes aren’t free from taxation either. NEXT: One of its cities, Sioux Falls, was once known as the “Divorce Capital of the World.” Bobak Ha’Eri/Wikimedia Commons 31. South Dakota Cost of living: 4 percent above U.S. average Population: 882,235 (as of 2018, says U.S. Census Bureau) Best city: Hot Springs, says Niche.com PRO: The home of Mount Rushmore earned itself a “Most Tax-Friendly” label from Kiplinger. Besides affordability, nature lovers might love its mountains and prairies. CON: Make sure you’re OK with blizzards and freezing weather before moving here. Like we note with most rural states: This state isn’t for city lovers! No big cities to speak of and it’s one of the least populated states. NEXT: It has its own version of oatmeal called “Cream of the West.” People have been eating this since 1914. Hasselblad500CM/Wikimedia Commons 30. Montana Cost of living: 3 percent above U.S. average Population: 1.062 million, says the U.S. Census Bureau Best city: Glasgow, says Niche.com PRO: It might be cold out but it’s beautiful — Montana boasts natural wonders like Glacier and Yellowstone national parks. Kiplinger says that it has one of the highest populations of 65 plus individuals. CON: Living in Montana might give retirees a tough time — Kiplinger rates the Treasure State as “Not Tax-Friendly.” Its income levels are below average and most retirement incomes are taxed including Social Security. There isn’t a lot to do in this state if you’re not very into nature. Lifestyle is an important factor to consider when moving! NEXT: The bolo tie is the “official neck wear” of this Southwestern state. Frayle/FreeGoodPhotos 29. Arizona Cost of living: 3 percent above U.S. average Population: 6.7 million Best city: Green Valley PRO: The Grand Canyon State has lots of sunshine and beautiful desert landscape, making it a popular retirement destination for those sick of icy winters. It’s easier to retire in than states like California or New York with its three percent above U.S. national average cost of living. CON: Arizona’s dry heat makes it almost unbearable during summertime, with temperatures in some localities reaching between 104 and 107 degrees Fahrenheit. It’s not the cheapest to live in with average household income for seniors 10.8 percent below national average. NEXT: Possibly the world’s largest “french fry feed” is held here. In 2015, 5,220 pounds of fries were served. James Brooks/Wikimedia Commons 28. North Dakota Cost of living: one percent above the U.S. average Population: 760,077 (as of 2018 says U.S. Census Bureau) Best city: Rugby, says Niche.com PRO: Kiplinger rates North Dakota tax-friendly to retirees (income taxes are low — 1.1 to 2.9 percent) and says it has a low cost of living. Its natural landscapes are absolutely breathtaking to boot! CON: The state taxes retirement income but that shouldn’t have too big of an effect on retirees since cost of living is so low. Again, it isn’t the best place for city folk — its population is just 760,077. NEXT: This state has the largest city in the contiguous 48 states. FreeGoodPhotos 27. Florida Cost of living: 1 percent above U.S. average Population: 19.9 million Best city: Jacksonville PRO: Here’s probably one of the most tax-friendly states in the United States. Perhaps this, along with its endless sunshine, is why Florida has the highest share of seniors in the U.S. Its benefits are also very fiscally secure. CON: Weather in Florida can turn nasty. Heat and humidity can be a nuisance, and even dangerous to seniors with poor health. There’s also the danger of hurricanes and intense thunder and lightning storms. Other than hurricane weather, it’s pleasant and warm mostly… NEXT: The first female U.S. governor, Nellie Taylor Ross, served from 1925 to 1927 in this state. J. Miers/Wikimedia Commons 26. Wyoming Cost of living: U.S. average Population: 577,737 (as of 2018 says U.S. Census Bureau) Best city: Cody, says SmartAsset PRO: The Mercatus Center rated the Equality State fifth in its fiscal health — out of 50 states, that’s pretty good! There’s no state income tax either which makes things easy on a retiree’s wallet. CON: If you’re not a nature lover and more of a city-dweller, living in Wyoming isn’t for you. It’s got one of the smallest populations in the U.S. at 577,737 and nary a giant metropolitan area in sight. Regardless, it’s hard to deny the state’s natural beauty. NEXT: Donut holes were invented in this state. Delicious! Ben Stephenson/Wikimedia Commons 25. Maine Cost of living: 2 percent below the U.S. average Population: 1.3 million Best city: Portland PRO: If you’re a fan of lobster, you don’t have to look far to get the good stuff. Both cost of living and healthcare costs are below the national average, which is good for retirees living off retirement income and savings. CON: The tax situation in Maine is just OK — most retirement income is taxable. However, Social Security isn’t taxed and estate tax only applies to estates worth $11.8 million and above. Income levels aren’t high, says Kipling. Senior households make 25.2 percent below the national average. NEXT: Social Security, pensions and retirement account withdrawals from its state income tax are exempt in this state. rev2212ruready/Pixabay 24. Pennsylvania Cost of living: 3 percent below U.S. average Population: 12.8 million Best city: Pittsburgh PRO: Forbes named Pittsburgh as the best city in the U.S. to retire in. It has a high number of doctors per capita and is very walkable and bikeable. Pennsylvania, in general, is good to retirees with inexpensive healthcare and tax breaks. CON: Pennsylvania isn’t sturdy in its own budget, making its future questionable. Financially unsound states (for example, Kansas) might raise taxes, which could affect senior citizens. George Mason University rates Pennsylvania’s fiscal health at 45 out of all 50 states. NEXT: The official bird of this state’s capital is the plastic lawn flamingo. BruceEmmerling/Pixabay 23. Wisconsin Cost of living: 4 percent below U.S. average Population: 5.8 million Best city: Madison PRO: Cost of living is low and there are some tax breaks for low-income residents’ retirement income. Cheese lovers will love being in proximity to some of the best cheese in the nation, as well as cheese curds. Yum! CON: Wisconsin isn’t very tax-friendly and has the lowest household income for people 65 and older in the nation. Although Social Security is exempt, other retirement income is subject to taxation. The icing on the cake: Healthcare costs are higher than the U.S. average. NEXT: This state is home to the largest bottle of ketchup. Dori/Wikimedia Commons 22. Illinois Cost of living: 4 percent below U.S. average Population: 12.9 million Best city: Leland Grove PRO: Illinois’ fiscal standing has been declining for a while. On the up hand, that means its cost of living is below the national average possibly making it pretty affordable for some retirees. Suburban town, Leland Grove, is ranked as the best place in Illinois to retire in according to Niche. CON: However, its fiscal standing has put Illinois in the second-lowest ranking for fiscal soundness. Tax breaks on a variety of retirement incomes aren’t assured and there are high sales taxes. NEXT: Most of the mainstream population knows this state for its potatoes. Nikopoley/Wikimedia Commons 21. Idaho Cost of living: 5 percent below the U.S. average Population: 1.6 million Best city: Sandpoint PRO: Nature lovers will enjoy the various environments in Idaho — the rugged landscape, snow-capped mountains, lakes, and canyons. Its cost of living allows retirees to really stretch their dollar and live thrifty Golden Years. CON: Those craving big city livin’ will not have a great time in Idaho. You’ll need to go to a more metropolitan area for that kind of lifestyle! Its tax-friendliness is a mixed bag for seniors: state tax is six percent and state income tax is over seven percent. However Social Security isn’t taxed and there’s no inheritance or estate tax. NEXT: Some celebrities to come out of this state are John Denver, Jeff Bezos and Georgia O’Keeffe. USDA/Wikimedia Commons 20. New Mexico Cost of living: 5 percent below U.S. average Population: 2.095 million (as of 2018, says U.S. Census Bureau) Best city: Taos, says SmartAsset PRO: Don’t let the drama on Better Call Saul and Breaking Bad fool you — New Mexico is a gorgeous and mostly peaceful place to live. CON: Its deserts and golden sunsets are beautiful but not its tax situation. Kiplinger says New Mexico is the “Least Tax-Friendly” state as retirement income is taxed here. Low-income seniors might be able to get benefits, however. NEXT: The local economy is strong in this state’s best city for retirees, making it a great place for retirement work. keiblack/Pixabay 19. North Carolina Cost of living: 5 percent below U.S. average Population: 9.9 million Best city: Asheville PRO: North Carolina usually has fairly mild weather year-round compared with most of the country. It’s very lush and green, great for nature lovers. Most costs of living are pretty low, save for the Kill Devil Hills area, and Social Security isn’t taxed. CON: Although costs of living are low, income levels are also low at an average of $43,616 for folks 65 years and older. Social Security isn’t taxed but other retirement income is taxable at a flat rate of 5.9 percent. NEXT: The first Civil War battle took place in this state. eurimaco/Wikimedia Commons 18. South Carolina Cost of living: 7 percent below U.S. average Population: 4.8 million Best city: Bluffton PRO: South Carolina has mild weather almost all year-round, making it an attractive retirement destination. Another draw? Its affordability, with cost of living 7 percent below the national average. With taxes being friendly to retirement incomes, you should be riding easy. CON: Summers get pretty hot and humid in this Southern state, although most of the time weather is pretty mild. Health isn’t the best in South Carolina with high obesity levels, many smokers, and low consumption of veggies. NEXT: A rare, Civil War-era, double-barreled cannon is on display in the city hall of this state’s best city for retirement. David R. Tribble/Wikimedia Commons 17. Georgia Cost of living: 7 percent below U.S. average Population: 10.1 million Best city: Athens PRO: Georgia has two things most people like: low living costs and warm weather. Healthcare is also inexpensive for retirees (sixth lowest costs for couples in the nation). Its low state taxes are also very appealing for budget-conscious retirees. CON: If you’re keen on Southern living, make sure you’re ready for Georgia’s long, hot and humid summers. Most people avoid the outdoors around noon because it’s way too sticky. An added nuisance: All the mosquitos! NEXT: The first public university in Thomas Jefferson’s Louisiana Purchase Territory is located in this state. Cassie Wright for Terry College of Business/Wikimedia Commons 16. Missouri Cost of living: 10 percent below U.S. average Population: 6.1 million Best city: Columbia PRO: Missouri’s low costs of living are very appealing for retirees — 10 percent below the nation’s average. Bookworms will also nerd out about all the famous writers from the “Show Me State” like Maya Angelou, Mark Twain, T.S. Eliot, and more. CON: It’s cheap to live in Missouri but that doesn’t help too much as household income levels are also pretty low (for 65 plus persons, it’s a little over $43K). Its tax situation is mixed and it has poor healthcare for seniors. NEXT: This state’s best city for retirement has a seriously low crime rate. Library of Congress/Wikimedia Commons 15. Texas Cost of living: 10 percent below U.S. average Population: 27.0 million Best city: San Marcos PRO: Living costs are below the nation’s average and average income for folks 65 years of age and older isn’t bad. Incomes aren’t taxed heavily in Texas, so your dollar can stretch even further. There are cool cities, as well, like Austin and Dallas. CON: Overall, Texas is affordable except for its healthcare, a strong consideration for most retirees. Texas is high in poverty, unfortunately, with the sixth highest senior poverty rate in the U.S. at 10.8 percent. NEXT: A chef from this state is responsible for the monstrosity the “turducken” — a three bird roll-up Thanksgiving dish. Leaflet/Wikimedia Commons 14. Louisiana Cost of living: 10 percent below U.S. average Population: 4.6 million Best city: Baton Rouge PRO: Louisiana has low costs of living and lots of sights and activities to keep active seniors busy. There are the music and tourist attractions of New Orleans and Baton Rouge, famous cuisine, and natural wonders like the swamps. You won’t be at a loss for adventures here! CON: Living costs might be low, but so are incomes. The average for people 65 years and older is $50,744. That might make it hard to afford things like healthcare, which are 2.1 percent over the U.S. average costs. NEXT: This state was the birthplace of Kool-Aid in 1927. davidpinter/Wikimedia Commons 13. Nebraska Cost of living: 12 percent below the U.S. average Population: 1.9 million Best city: O’Neill PRO: Retirees will enjoy a very low cost of living in addition to a state with good fiscal health. (The Mercatus Center at George Mason University ranks Nebraska sixth in that category.) The city of O’Neill got an “A” for retiree living from Niche.com. CON: Cost of living is low, but it’s not very tax-friendly to seniors. Most retirement income is taxable, unfortunately. Social Security is only exempt if you make $43,000 or less for single filers, $58,000 for joint filers NEXT: The most visited national park is in this state. Bmanishreddy123/Wikimedia Commons 12. Tennessee Cost of living: 12 percent below U.S. average Population: 6.5 million Best city: Lookout Mountain PRO: Tennessee is tax-friendly to retirees. It doesn’t levy state income taxes so your retirement income can stretch further. All metro areas are very affordable in all senses, even healthcare which is usually a big concern for seniors. CON: Summertime can be unbearable, sometimes reaching 92 degrees Fahrenheit in July. Add some humidity, and the summer months might seem even hotter. Traffic isn’t great in Tennessee, especially around bigger cities Nashville and Memphis. Going out of town will require planning and patience. NEXT: The first traffic light in the U.S. was installed in this state. Kaldari/Wikimedia Commons 11. Ohio Cost of living: 12 percent below U.S. average Population: 11.6 million Best city: Bellbrook PRO: Geographically, Ohio’s central location makes it easy to travel to either coast to visit family and friends or go on vacation. Cost of living is quite low at 12 percent below the nation’s average and Social Security isn’t taxed. CON: Low costs of living and exempt Social Security is appealing, but its average household income for senior citizens isn’t that high. Ohio might work out for you if you have a lot of savings, otherwise, you’ll have to deal with the average income at $42,667. NEXT: This state celebrates “Log Cabin Day” every Sunday in June. Cleveland84/Wikimedia Commons 10. Michigan Cost of living: 12 percent below U.S. average Population: 9.9 million Best city: Farmington PRO: Its low cost of living and low poverty rate make Michigan very appealing to retirees. Also, Social Security isn’t taxed out here in the Great Lakes state. For those into water sports, the Great Lakes will make for a fun destination during Michigan’s spring and summer months. CON: Michigan is going to have a complicated tax situation in a few years. Come 2020, folks 67 plus must choose between deducting Social Security income or $20K of all income sources for singles, $40K for couples. NEXT: The house in the famous painting American Gothic by Grant Wood is in this state. Mikerussell/Wikimedia Commons 9. Iowa Cost of living: 12 percent below U.S. average Population: 3.1 million Best city: Iowa City PRO: Yay! No state income tax on Social Security earnings and a state income tax break for pension income! Iowa City is designated as a “City of Literature” by UNESCO and is home to a vibrant cultural scene and famous university. CON: Taxes aren’t easy on seniors’ wallets in Iowa, despite Social Security benefits being untaxed. Retirement income might be hit by up to 8.98 percent. However, people 55 and up can exclude up to $6,000 of taxable retirement income. NEXT: This state introduced Mardi Gras to the Western World. Vkulikov/Wikimedia Commons 8. Alabama Cost of living: 13 percent below U.S. average Population: 4.8 million Best city: Orange Beach PRO: Head down to the Heart of Dixie where it’s budget-friendly. Most spend 4.4 percent less than the average retired couple on healthcare, income taxes are from 2 to 5 percent, and Social Security benefits are exempt. CON: Storms can get intense during spring and November, with lots of rain and thunderstorms. Like most Southern states, Alabama will be hot, hot, hot during the summer. When picking a place to live, consider how southern Alabama is warmer than the North. NEXT: A ball of twine weighing 16,750 pounds is located in this state. Charles Lowry/Wikimedia Commons 7. Kansas Cost of living: 14 percent below average Population: 2.9 million Best city: Eureka PRO: Cost of living is pretty low in the Sunflower State, which might convince you that there’s no place like home in Kansas (get it? Wizard of Oz reference?). Its scenic plains and prairies are also appealing to any nature lovers out there. CON: Kansas isn’t in the best financial shape so it’s raising taxes to rectify its budget deficit. Most retirement incomes, including Social Security, will be subject to state taxes with rates from 3.1 to 5.7 percent. Might not be the best place if you’re very budget conscious. NEXT: The “Horse Capital of the World” is in this state. Kansas City District U.S. Army Corps of Engineers – Turtles/Wikimedia Commons 6. Kentucky Cost of living: 14 percent below average Population: 4.4 million Best city: Lexington PRO: Welcome to the Bluegrass State, where retirees can enjoy low living costs and a high number of tax breaks. Social Security and $41,110 of other income are exempt from taxes. However, it’s not the healthiest place for senior folks… CON: Senior health costs aren’t cheaper than other states — it’s about at the U.S. average. It also ranks badly in senior health, with high rates of smoking, physical inactivity, and poverty. There’s also a low number of good nursing homes to care for seniors. NEXT: Root beer was invented in this state. Russell and Sydney Poore/Wikimedia Commons 5. Mississippi Cost of living: 15 below U.S. average Population: 3.0 million Best city: Hide-A-Way Lake PRO: Seniors might like Mississippi’s sweet tax breaks and low costs on everyday items. All of your Social Security, distributions from IRAs and 401Ks, and other retirement incomes won’t be subject to taxes. Also, those property taxes are the lowest in the country. CON: While Mississippi taxes and living costs are easy on the wallet, the state ranks last for senior health according to the United Health Foundation. It also has the worst poverty rate in the country for seniors — 13.4 percent. NEXT: Abraham Lincoln lived in this state when he was a child. Allstarecho/Wikimedia Commons 4. Indiana Cost of living: 15 percent below U.S. average Population: 6.6 million Best city: Meridian Hills PRO: Indiana’s cost of living is 15 percent below the national average, meaning everyday expenses like food, housing, gas, etc, are much more affordable. These things would take a hit on your wallet in places like California and Hawaii. CON: The state of Indiana is best for seniors with lots of savings as its annual income is below the U.S. average (21.4 percent below to be exact) and retirement income, other than Social Security, is taxable at ordinary rates. NEXT: Voicemail was patented by a man from this state. Diego Delso/Wikimedia Commons 3. Oklahoma Cost of living: 16 percent below U.S. average Population: 3.9 million Best city: Nichols Hills PRO: Low costs of living will most benefit those that have lots of retirement savings. Oklahoma is also one of the states that doesn’t tax Social Security and up to $10K can be excluded from retirement income. This helps considering average incomes are low. CON: Oklahoma ranks third-worst for senior health. Not only are there high levels of physical inactivity and smoking, but there’s also a lack of geriatric care and good nursing homes available to treat all the health problems. NEXT: The world famous Greenbrier Hotel is located here with springs that are rumored to cure many ailments. Twitter https://twitter.com/3530Tech/status/1121066067504324608 2. West Virginia Cost of living: 17 percent below U.S. average Population: 1.806 million (as of 2018, says U.S. Census Bureau) Best city: Lewisburg, says Niche.com PRO: Its cost of living isn’t too bad, at 17 percent below the U.S. average. The state is known for scenic views, a rich history, grand resorts, and more, says USA Today. CON: Kiplinger says the Mountain State isn’t tax-friendly to retirees and ranks low for its fiscal soundness, according to the Mercatus Center at George Mason University. It also has poor healthcare for 65 plus individuals. NEXT: The first woman elected to the U.S. Senate, Hattie Ophelia Caraway, was from this state. Brian Stansberry/Wikimedia Commons 1. Arkansas Cost of living: 17 percent below U.S. average Population: 3.0 million Best city: Bella Vista PRO: Quite a low cost of living in the Natural State, as well as average health costs being the third lowest for retired couples. Arkansas is known for its wildlife, hot springs, mountains, and rivers — hence the name the “Natural State.” CON: Arkansas’ state taxes aren’t that easy on the wallet. Social Security benefits and up to $6,000 of other retirement income are exempt. Top income tax rates can hit 6.9 percent if the income exceeds $75,000. Poverty rates in Arkansas for seniors are the eighth highest in the U.S. Also, this Southern state isn’t the place to be for those craving big city living! NEXT: These are the worst states for retirement. USDA Natural Resources Conservation Service/Wikimedia Commons You won’t believe that these are the worst states for retirees The best states for retirees have a combination of good healthcare options, cheap costs of living, and low taxes. Some states might have great weather or lots to do but make for not great places to live out your Golden Years. According to Kiplinger, these are a handful of states on the West and East Coasts. Some of these are New York, Massachusetts, Maryland, New Jersey, Connecticut, Rhode Island, and California. California’s cost of living is 52 percent above the U.S. average but Connecticut, Maryland, Massachusetts, Rhode Island, and New York are the least tax-friendly. Save up for retirement if you’re intent on staying in these states!